Market

-

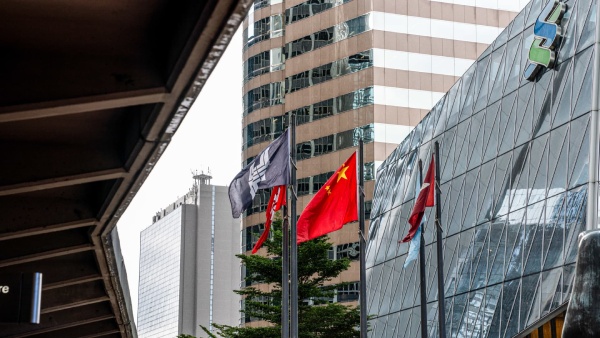

Chinese tech stocks bounce as Hong Kong leads gains among Asia-Pacific business sectors

SINGAPORE – Hong Kong’s Hang Seng record drove gains among the significant Asia-Pacific business sectors on Monday as Chinese tech stocks in the city bounced. In morning exchange, the Hang Seng file acquired 1.42% as portions of Tencent flooded 2.06%. Other Chinese tech stocks likewise rose, with Alibaba up 2.83% while NetEase took off 4.43%. The city’s CEO Carrie Lam declared she won’t be seeking after a second term in office. Markets in central area China are shut on Monday and Tuesday this week for occasions. The Nikkei 225 in Japan swung among a positive and negative area, last slipping 0.14% as portions of Fast Retailing dropped 2.04%. The Topix…

-

GameStop tries to part stock interestingly beginning around 2007, shares hop almost 17% in late night exchanging

Portions of GameStop Corp. hopped almost 17% in night-time exchanging Thursday, after the organization reported that leaders are seeking conduct a stock split without precedent for 15 years. The videogame retailer reported that it intended to request that investors for approval increment its portion build up to 1 billion from 300 million so it can do a stock split as a profit. The organization additionally anticipates that that the move should expand its portion count would “give adaptability to future corporate requirements,” a recording with the Securities and Exchange Commission expressed. GameStop GME didn’t determine in the recording the proportion by which it expected to divide its stock assuming the…

-

Financial backers accept the greatest danger to the business sectors currently is a Fed stumble, CNBC overview shows

A greater part of Wall Street financial backers accept the greatest danger confronting the business sectors right currently is an approach mistake by the Federal Reserve as the national bank grapples with subduing many years high expansion, as indicated by the new CNBC Delivering Alpha financial backer review. We surveyed around 400 boss venture officials, value specialists, portfolio chiefs and CNBC givers who oversee cash about where they remained on the business sectors for the remainder of 2022. The overview was led for this present week. 46% of the overview respondents said a Fed stumble could can possibly crash the buyer market, while 33% said flooding U.S. expansion represents a…

-

Japan’s Nikkei 225 shuts 3% higher as SoftBank Group shares jumped 7%

Japan’s Nikkei 225 rose 3% on Wednesday, shutting down at 28,040.16 as portions of SoftBank Group bounced 7.22% while Fast Retailing climbed 5.21%. In Hong Kong, portions of Xiaomi took off 6.06% after the firm reported Tuesday intends to repurchase partakes in the open market “now and again” at a greatest total cost of 10 billion Hong Kong dollars (about $1.28 billion). Financial backers additionally checked moves in the oil markets, with sources advising that the European Union is probably not going to force a prompt oil ban on Russia over its unjustifiable intrusion of Ukraine. Japan’s Nikkei 225 rose 3%, shutting down at 28,040.16 as portions of SoftBank Group…

-

Oil costs falls marginally as market unpredictability facilitates

Stocks revitalized and oil costs fell forcefully Wednesday as the huge swings shaking worldwide business sectors head down the two paths in the midst of vulnerability about the conflict in Ukraine. Oil costs fell toward the start of exchanging on Sunday evening, in a break from the instability of ongoing weeks Russia’s assault on Ukraine grind on. The Dow Jones Industrial Average acquired 654 focuses, or 2%, to close at 33,286. The S&P 500 rose 3.6%, finishing a four-day losing streak, and the tech-weighty Nasdaq composite added 3.6%. Such large swings have been snapping markets around as of late as financial backers attempt to survey how much monetary harm Russia’s…

-

Stock futures plunge after Dow hits rectification, Nasdaq come in to bear market

U.S. value fates ticked lower in post-market compromising Monday after a sell in the prior meeting that saw the Dow Jones Industrial Average fall into remedy an area and the Nasdaq enter a bear market. Financial backers kept on casting off stocks and reserve place of refuge resources as worries over the monetary outcomes of Russia’s conflict in Ukraine escalated. What Is a Bear Market?A bear market is the point at which a market encounters delayed cost declines. It ordinarily depicts a condition where protections costs fall 20% or more from ongoing highs in the midst of far and wide cynicism and negative financial backer opinion. Energy costs spiked throughout…

-

strategist says a bear market is arriving , and with it ways of bringing money not found in 40 years

After Russia-Ukraine stresses tipped the S&P 500 into rectification region on Tuesday, financial backers are appropriately asking what’s straightaway? Concerning that revision, history lets us know values will quite often ultimately bounce back from those slumps, with recuperations a year after the fact even on account of a bear market. Proof is stacking up for that huge pullback, says our call of the day from the organizer and CEO of BullAndBearProfits.com, Jon Wolfenbarger. “The example recommends some help before nervousness incorporates into the mid-March meeting,” says the blogger. Obviously, it additionally shows one more ricochet to come. Subsequent to cautioning us in October, the bulletin manager who burned through 22…

-

Dow futures falls almost 500 points as stress among Russia and Ukraine

Stock prospects fell forcefully early Tuesday morning, as dealers keep on observing blending strains among Russia and Ukraine. U.S. stock-record fates were pointedly lower early Tuesday, however off the most obviously awful levels for the time being, when Russian President Vladimir Putin requested the sending of troops to dissident regions inside Ukraine, subsequent to perceiving their freedom, a move that some dread puts Ukraine and Russia one bit nearer to military clash. Prospects attached to the Dow Jones Industrial Average were somewhere near 493 focuses, or 1.39%. S&P 500 fates slid 1.74%, and Nasdaq 100 fates were off by 2.6%. The U.S. financial exchange was shut Monday because of the…

-

US stocks drop again as Russian invasion danger proceeds

US stocks slid Friday as financial backers kept on following international advancements in Eastern Europe following Thursday’s precarious selloff. The Dow (INDU) shut down almost 233 focuses, or 0.7%. The S&P 500 (SPX) and Nasdaq (COMP) Composite finished the day with misfortunes of 0.7% and 1.2%. U.S. stocks fell in all cases as financial backers watched out for heightening concerns over the chance of Russia attacking Ukraine. Each of the three records completed the week in the red for the second consecutive week. On Thursday, as fears of a Russian attack of Ukraine developed, Wall Street withdrew, sending the Dow down 622 focuses, or 1.8% – its most awful day…

-

strategies for managing market unpredictability

The most recent couple of weeks have filled in as a distinct update that stocks can be unpredictable – at times incredibly so. The S&P 500 fell by over 5% in January, its most awful presentation since the pandemic started, and markets stayed uneven through the initial fourteen days of February. Specialists anticipate that the unpredictability should go ahead, in the midst of worries about expansion and increasing loan fees, international vulnerability, and the continuous pandemic. Look for speculations with low connectionLonger term, the market hazard related with a singular resource class, like stocks, might be diminished by dispensing a piece of a portfolio’s resources for different sorts of speculations…